Are Stock Sales Taxable In Pa . A capital gain is any profit from the sale of a stock, and it has unique tax implications. Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from the day you invested,. Here's what you need to know about selling stock and the taxes you may have to. Pa does not distinguish between long or short term. There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. As a pa resident, all gains are taxable. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be excluded from. A resident shareholder must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value. June 1, 2019 7:41 am.

from www.markham-norton.com

A capital gain is any profit from the sale of a stock, and it has unique tax implications. Here's what you need to know about selling stock and the taxes you may have to. As a pa resident, all gains are taxable. A resident shareholder must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be excluded from. There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. Pa does not distinguish between long or short term. Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from the day you invested,. June 1, 2019 7:41 am.

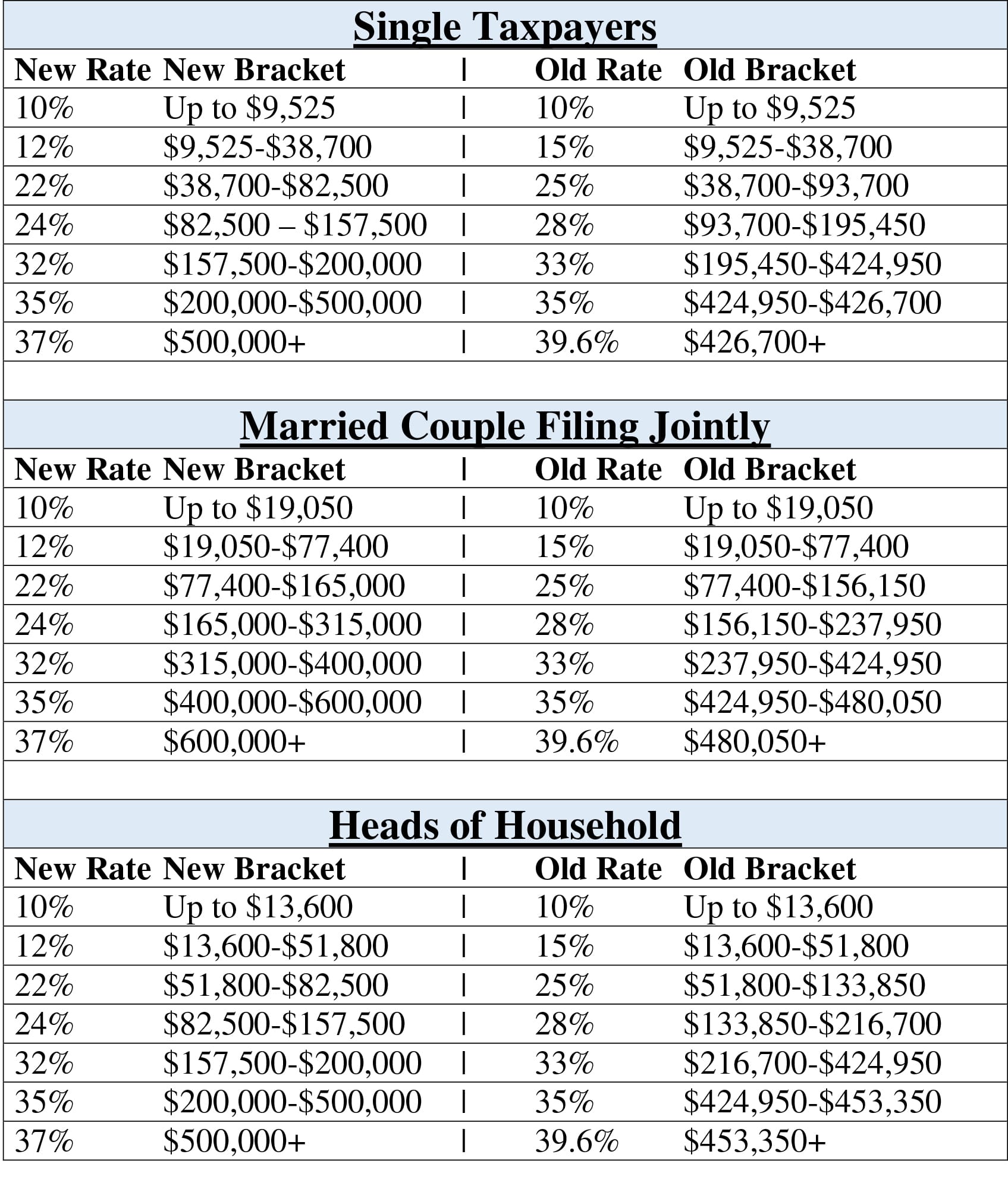

Comparison of New and Old Tax Brackets Starting Markham Norton

Are Stock Sales Taxable In Pa A capital gain is any profit from the sale of a stock, and it has unique tax implications. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be excluded from. A capital gain is any profit from the sale of a stock, and it has unique tax implications. A resident shareholder must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value. Pa does not distinguish between long or short term. June 1, 2019 7:41 am. Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from the day you invested,. Here's what you need to know about selling stock and the taxes you may have to. As a pa resident, all gains are taxable. There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the.

From www.formsbank.com

Instructions For Withholding Pa Personal Tax From Nonresident Are Stock Sales Taxable In Pa Here's what you need to know about selling stock and the taxes you may have to. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be excluded from. There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be. Are Stock Sales Taxable In Pa.

From sftaxcounsel.com

Determining Taxable Gains from the Sale of CFC Stocks SF Tax Counsel Are Stock Sales Taxable In Pa Here's what you need to know about selling stock and the taxes you may have to. A resident shareholder must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of. Are Stock Sales Taxable In Pa.

From blog.shoonya.com

Tax Implications of Stock Market Investments & Trading in India Are Stock Sales Taxable In Pa Pa does not distinguish between long or short term. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be excluded from. As a pa resident, all gains are taxable. Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from. Are Stock Sales Taxable In Pa.

From www.truewealthdesign.com

Should I Sell a Stock with a Large Taxable Gain? (Part 1) True Wealth Are Stock Sales Taxable In Pa Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from the day you invested,. June 1, 2019 7:41 am. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be excluded from. A resident shareholder must report as taxable gain. Are Stock Sales Taxable In Pa.

From www.alamy.com

Sales tax ID yellow color icon. Price formation. Business profit and Are Stock Sales Taxable In Pa As a pa resident, all gains are taxable. Here's what you need to know about selling stock and the taxes you may have to. There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. A resident shareholder must report as taxable gain for. Are Stock Sales Taxable In Pa.

From www.signnow.com

Pa Tax Trust Inheritance Complete with ease airSlate SignNow Are Stock Sales Taxable In Pa As a pa resident, all gains are taxable. Pa does not distinguish between long or short term. There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. Here's what you need to know about selling stock and the taxes you may have to.. Are Stock Sales Taxable In Pa.

From mungfali.com

Historical Chart Of Tax Rates Are Stock Sales Taxable In Pa Pa does not distinguish between long or short term. Here's what you need to know about selling stock and the taxes you may have to. There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. Capital gains are not taxed until they are. Are Stock Sales Taxable In Pa.

From www.youtube.com

Pennsylvania Tax Sales Tax Deeds YouTube Are Stock Sales Taxable In Pa Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be excluded from. June 1, 2019 7:41 am. Pa does not distinguish between long or short term. Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from the day you. Are Stock Sales Taxable In Pa.

From www.paisabazaar.com

How are Your investments taxed when sold? Paisabazaar Are Stock Sales Taxable In Pa As a pa resident, all gains are taxable. A resident shareholder must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value. June 1, 2019 7:41 am. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be. Are Stock Sales Taxable In Pa.

From www.youtube.com

What is not taxable in Pennsylvania? YouTube Are Stock Sales Taxable In Pa There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. June 1, 2019 7:41 am. Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from the day you invested,. A capital gain is. Are Stock Sales Taxable In Pa.

From www.youtube.com

Should I hold Dividend Stocks in a Taxable OR Retirement Account? YouTube Are Stock Sales Taxable In Pa A resident shareholder must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value. A capital gain is any profit from the sale of a stock, and it has unique tax implications. Capital gains are not taxed until they are realized, meaning that even if your apple stock. Are Stock Sales Taxable In Pa.

From avocadoughtoast.com

Taxes on Stocks How to Pay Less Avocadough Toast Are Stock Sales Taxable In Pa Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from the day you invested,. June 1, 2019 7:41 am. Here's what you need to know about selling stock and the taxes you may have to. A resident shareholder must report as taxable gain for the tax year in which it. Are Stock Sales Taxable In Pa.

From topforeignstocks.com

Dividend Withholding Tax Rates by Country for 2023 Are Stock Sales Taxable In Pa There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. Here's what you need to know about selling stock and the taxes you may have to. Capital gains are not taxed until they are realized, meaning that even if your apple stock has. Are Stock Sales Taxable In Pa.

From help.petrosoftinc.com

b) Common Report Are Stock Sales Taxable In Pa There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. A capital gain is any profit from the sale of a stock, and it has unique tax implications. Capital gains are not taxed until they are realized, meaning that even if your apple. Are Stock Sales Taxable In Pa.

From www.formsbank.com

Fillable Pa Taxable Interest And Dividend Form Pa Schedule A/b Are Stock Sales Taxable In Pa There are no provisions within pennsylvania personal income tax law that permit the gain on the sale of stock to be treated as a gain on the. As a pa resident, all gains are taxable. Pa does not distinguish between long or short term. Capital gains are not taxed until they are realized, meaning that even if your apple stock. Are Stock Sales Taxable In Pa.

From equitablegrowth.org

Taxing wealth by taxing investment An introduction to markto Are Stock Sales Taxable In Pa A resident shareholder must report as taxable gain for the tax year in which it was received or credited, the excess of the fair market value. Here's what you need to know about selling stock and the taxes you may have to. As a pa resident, all gains are taxable. Pennsylvania does not have any provision similar to irc 1202. Are Stock Sales Taxable In Pa.

From lessonschoolbathetic.z5.web.core.windows.net

Maine Earned Tax Credit Worksheet Are Stock Sales Taxable In Pa June 1, 2019 7:41 am. A capital gain is any profit from the sale of a stock, and it has unique tax implications. Pa does not distinguish between long or short term. Pennsylvania does not have any provision similar to irc 1202 that would allow gain from a sale of stock to be excluded from. A resident shareholder must report. Are Stock Sales Taxable In Pa.

From www.wtae.com

Pennsylvania sales tax Which items are taxable, and what's exempt? Are Stock Sales Taxable In Pa As a pa resident, all gains are taxable. A capital gain is any profit from the sale of a stock, and it has unique tax implications. Capital gains are not taxed until they are realized, meaning that even if your apple stock has increased 50x from the day you invested,. There are no provisions within pennsylvania personal income tax law. Are Stock Sales Taxable In Pa.